A Quiet Shift in Oregon’s Tax Politics

The Takeaway

Usually, state policy is the center of attention during Oregon's legislative sessions. With thousands of bills introduced, and at least this early in the process, everything and anything seems to have a chance. This year, however, the politics are simply different. The usual high-stakes battles over policy are unfolding, but they are overshadowed by broader financial uncertainty—fueled by the federal funding freeze and evolving state budget concerns.

Despite a federal judge halting agencies from withholding funds to states and nonprofits, some funds remain frozen, stalling programs and delaying capital projects. State and local governments are actively running an inventory of affected programs, with examples including a $200 million federal climate grant to the Oregon Department of Environmental Quality, a $33 million wildlife crossing for the City of Ashland, and a $10 million wildfire mitigation project in Southern Oregon. The list of impacted programs is growing, with both the financial and personnel costs yet to be fully realized.

The federal funding freeze might not necessarily affect the day-to-day life of all Oregonians, but it is putting significant strain on the already fragile politics of state and local spending decisions. With more than 31 percent of the state’s budget coming from the federal government, lawmakers are deeply concerned about federal spending cuts impacting the state’s fiscal and revenue outlook.

Heading into the session, Oregon’s economists told lawmakers they were flush with new revenues to spend in their next budget. Those projections fueled a seemingly endless list of spending requests for new and existing programs. While every indication suggests the state still has a revenue surplus, potential losses of federal funding could more than offset those gains, injecting substantial uncertainty into the budget-writing process. (A function of the legislature that drives most other politics.)

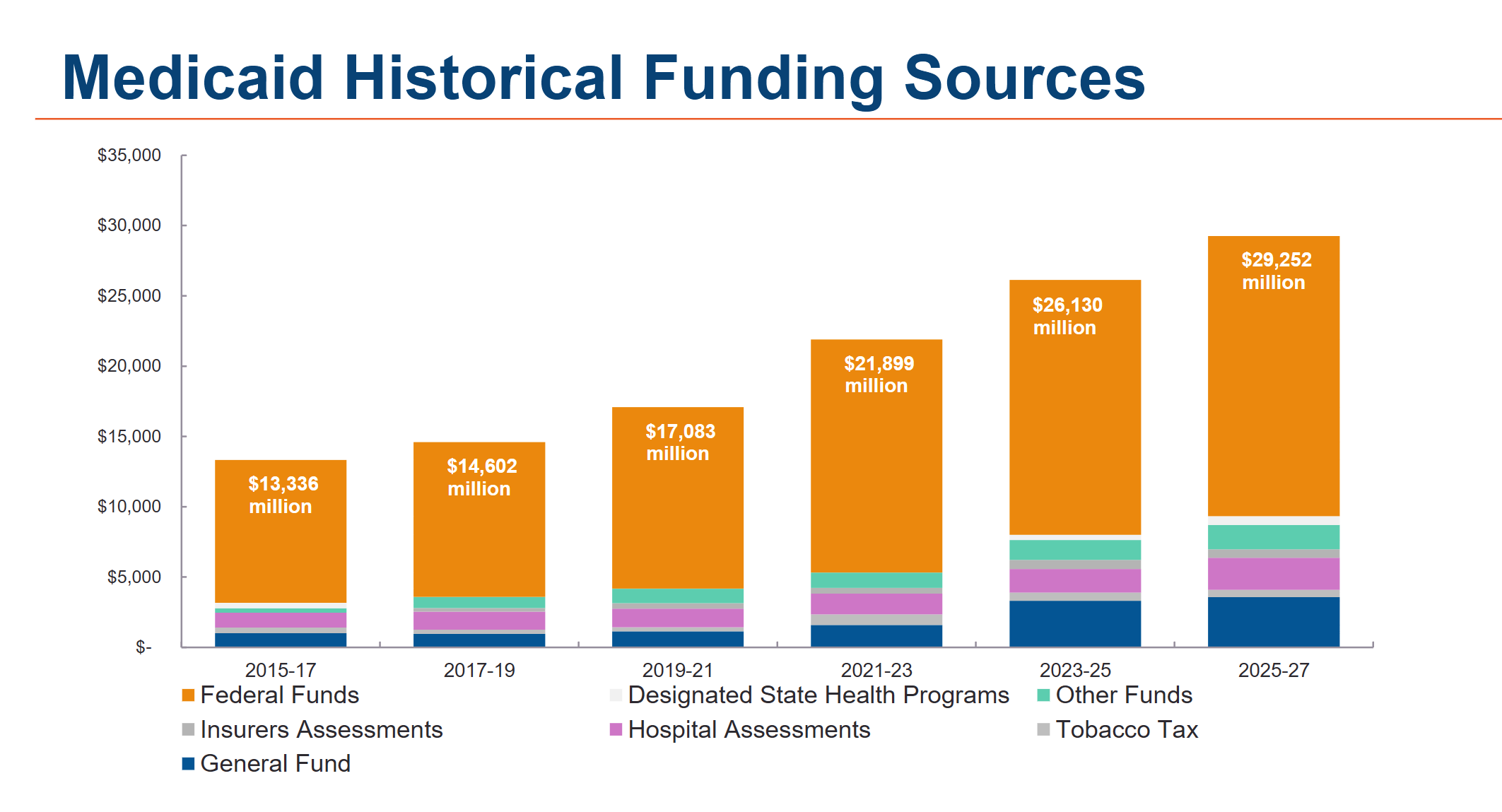

Lawmakers are moving swiftly to pass their first major funding bill of the session—a package of Medicaid taxes used to secure $6.6 billion in additional funds. Since 2003, Oregon has raised revenues through a federal policy regime known as the “provider tax,” a series of assessments on hospitals, managed care groups, and commercial insurance premiums paid by businesses and individuals. The federal government provides an enhanced match—usually three dollars for every dollar the state raises.

Oregon reviews and adjusts its slate of provider taxes every few years, and while all tax votes are inherently controversial, these Medicaid taxes tend to find bipartisan support. Unlike many other taxes pooled into the state’s general fund, these resources provide dedicated funding for health care services across the state. The healthcare industry, including the groups paying these charges, also supports the taxes because they receive an economic benefit from the federal match. In the world of tax politics, these Medicaid taxes are usually an easy political win.

However, despite bipartisan backing, some in the legislature are using the Medicaid taxes as an opportunity to whittle away the constitutional rules around raising revenue, which require a three-fifths supermajority to approve new or increased taxes (36 votes in the House and 18 in the Senate). About a decade ago, the Oregon Supreme Court significantly narrowed the types of bills subject to the requirement. Without delving too deep into the weeds, the Court ruled a measure must (1) bring revenue to the state treasury and (2) contain the essential features of a bill levying a tax. Additionally, Oregon law treats taxes and fees differently. Taxes are charges in support of the general welfare of the state, and fees serve a regulatory function where the payer receives a direct benefit.

Although it might not be front and center in legislative discussions, Democrats and Republicans routinely clash over the application of the constitutional rule. Besides the traditional partisan sentiments toward tax increases, disputes over the rules for raising revenue are generally about political leverage. If Democrats can successfully minimize the number of bills requiring the increased vote threshold, they empower themselves when they only have simple majority control. It also allows moderate and politically vulnerable members of the majority party to avoid votes on tax increases that could weaken their party's control in the legislature. Meanwhile, Republicans routinely view the requirement as an opportunity to build leverage. If Democrats cannot pass a tax alone, they must work with Republicans to pass a tax, creating an advantage in the session’s negotiations. These battles are at the heart of Oregon’s tax politics.

Historically, the Office of Legislative Counsel (the legislature’s lawyers who draft and provide legal analysis) advised lawmakers the Medicaid taxes met the criteria for revenue-raising bills requiring a supermajority vote. In 2013, 2015, and 2017, the bills included language explicitly stating they required a three-fifths majority. However, in 2019, a relatively uncontroversial proposal to extend the taxes for six years omitted this statement but passed with broad bipartisan support.

Now, in the current session, lawmakers are again considering a proposal to renew these Medicaid taxes. While there is general agreement on their necessity, Republicans in the superminority are increasingly wary of tax votes. HB 2010, the latest iteration, does not include language affirming the need for a three-fifths vote, a point of contention for some legislators.

During a hearing of the House Revenue Committee on Thursday, Legislative Counsel was asked to explain the measure’s absence of the ordinary supermajority requirement. The attorney explained it was no longer their opinion the Medicaid taxes functioned as taxes because the hospitals, managed care groups, and insurance companies benefitted from the charge—effectively making the taxes regulatory fees. Republicans pushed back, strongly objecting to the notion that a charge (tax) on people purchasing health insurance served a regulatory purpose when the insurer (and not the purchaser) is the entity receiving the benefit. The bill advanced out of committee on a party-line vote.

If you’ve made it this far (first of all, thank you), you might wonder why this legal distinction matters. For those not deeply involved in tax politics, Thursday’s hearing might have sounded like a drawn-out legal debate over the definitions of “tax” and “assessment.” Yet, beneath the surface, it represents one of this session's most consequential process debates. If Oregon’s rules around raising revenue gradually weaken, the political barriers to increasing taxes will also erode. And, in an environment of federal funding uncertainty, it could create new pressure points and opportunities for the legislature to creatively raise revenues.

What We're Reading This Week

- Governor Tina Kotek (D) announced executive branch changes to increase public engagement and transparency for state regulations and rulemaking.

- Governor Kotek also announced a pause for property owners appealing the state’s controversial wildfire risk maps until the legislature could change the law. Republicans held a press conference demanding the legislature repeal the maps to prevent further harm to rural residents.

- Oregon’s Department of Transportation is under the microscope for failing to meet accountability measures and depleting funds approved for projects from the last legislative transportation package, approved in 2017. Democratic leadership tapped Sen. Bruce Starr (R-Dundee) to develop a proposal to restore accountability in the state’s transportation agency.

- Oregon’s education funding system made news after reports of the state’s increased spending on public schools failed to significantly improve outcomes. In another report, commissioned by the legislature, researchers suggest the state needs to revamp the funding formula and dedicate more money to schools.

- Oregon needs more resources to fight wildfires; however, finding the funds to pay for those services might hit a sore spot, especially with a proposal to withhold the personal income tax kicker.

- Oregon Public Broadcasting reports the state’s fund to pay out civil settlements from wrongdoings is close to insolvency.

- In an analysis by Ballotpedia, Oregonians have rejected more ballot measures than they approved since 1900.