A Session Driven by Fixed Narratives

The Takeaway

The Oregon Capitol settled into an uneasy but familiar rhythm as the 2026 session began last week. Unlike previous sessions, when policy battles were fought over the margins, the political narratives for this session seem already set in stone. The facts on the ground regarding the state budget changed materially last week, yet some lawmakers and advocacy groups appeared uninterested in adjusting their priors to reflect reality. The result is a session in which new information is barely acknowledged, then quickly set aside, and the process continues along the same track as if nothing had happened.

Revenue Forecast

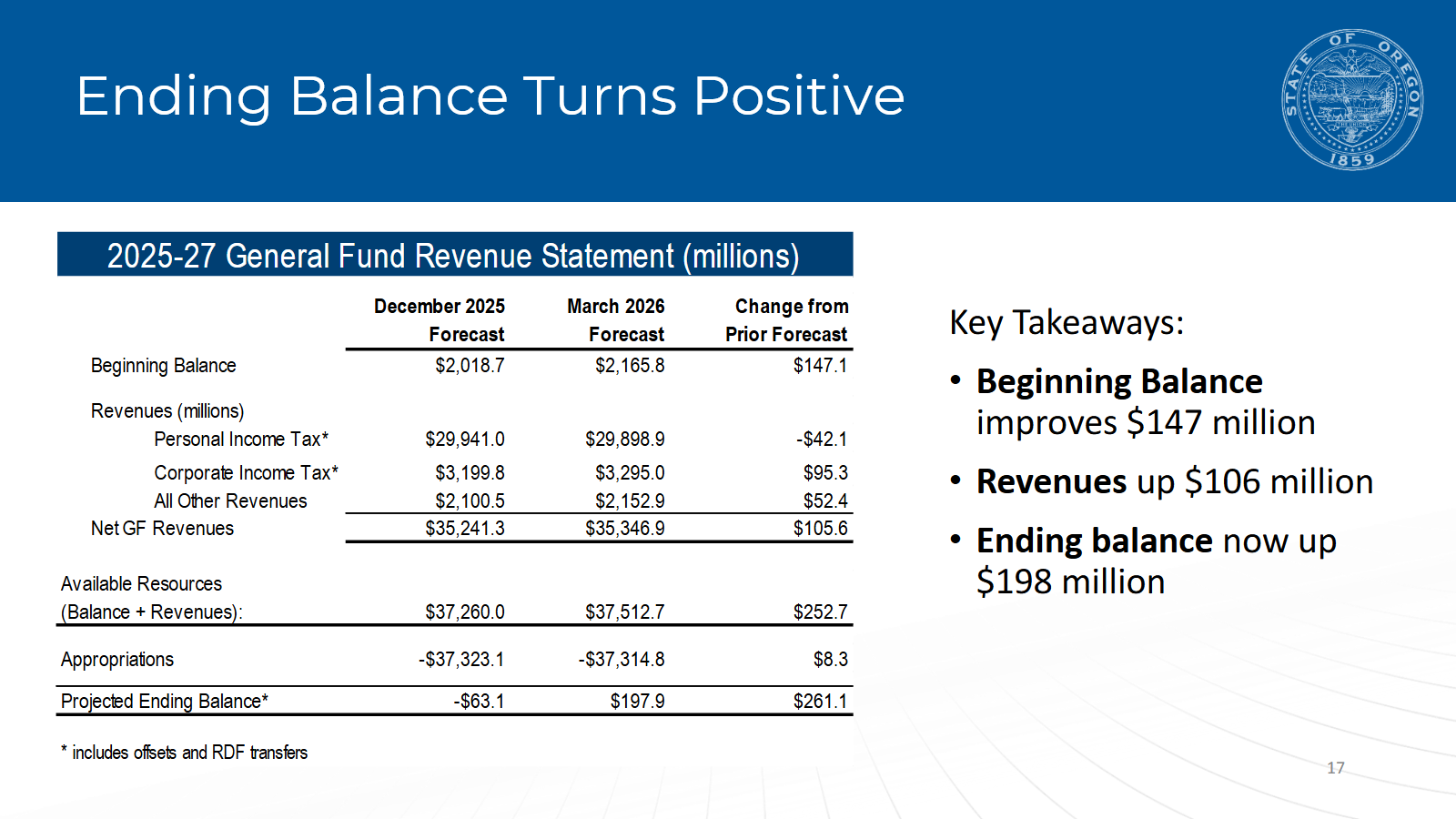

On Wednesday, the legislative revenue committees received news of a markedly improved revenue outlook. Last fall, lawmakers faced a $372.7 million revenue shortfall, setting the stage for intense debates over spending cuts and tax increases. In the latest revenue forecast, however, state economists informed the legislature they now anticipate a $198 million cushion — a $570 million swing over just a few months. News along these lines would normally change the tone of a session framed around scarcity. However, the forecast barely registered as a turning point. The committees moved quickly through the update, defying norms by instructing legislators to curtail their questions, and then proceeded to a hearing on a proposal to raise taxes. Despite a dramatic change in the state’s fiscal position, the politics were cemented.

Since last summer, Oregon’s public employee unions and their allied groups settled on a simple explanation for the state’s budget stress: federal tax law changes are to blame and the only response is to claw back tax relief from the “ultra wealthy” and “large corporations.” The unions went so far as to target moderate Democrats with a pressure campaign to persuade them to fall in line. The storyline may have fit more comfortably if the forecast had shown a deep and worsening hole. The deficit effectively evaporated, but the politics stayed anchored to the same premise.

Disconnecting from Federal Tax Law

Immediately following the revenue forecast, the Senate Finance & Revenue Committee proceeded to hold a hearing on a proposal to “disconnect” the state from several new provisions of federal tax law. Specifically, the proposal was to deny individuals a new tax deduction for auto loan interest, entrepreneurs a longstanding income exclusion for their equity in a startup, and businesses the ability to immediately deduct capital assets, pushing those write-offs into future years.

The most consequential element of the package is a proposal to deny businesses the ability to deduct capital expenses upfront. The policy, called full expensing, is not about creating a new write-off. These costs have always been deductible. The question is timing. Traditionally, businesses recovered capital purchases slowly over an asset’s useful life. Over time, lawmakers accelerated that recovery to improve cash flow and encourage investment. Full expensing is the logical endpoint, allowing the deduction to be taken immediately in the year the investment is made. If Oregon disconnects from the policy, it will not generate durable new revenues. It will simply pull revenue forward by deferring deductions.

The disconnect proposal functions a lot like a payday loan. The state receives a near-term cash boost by accelerating collections from future budget cycles, leaving future legislatures with a thinner revenue base once those deferred deductions come due. The tradeoff is not limited to state budgeting. Businesses lose cash-flow flexibility after making investments and compliance burdens rise sharply as firms are required to track Oregon-specific capital cost rules alongside a different federal policy. Like a cash advance, it solves a near-term problem by borrowing against future tax collections that are already likely to be tight. Accelerating revenue collections increases the likelihood that lawmakers confront genuine gaps down the road, artificially creating a greater need for additional tax increases.

Yesterday, the committee reconvened for a work session on the disconnect proposal and advanced the bill on a party-line vote, sending it to the floor. Under ordinary conditions, that kind of acceleration on a major and controversial tax measure would frame the rest of the session, but it has been quickly absorbed into a Capitol operating on fixed narratives. The transportation funding referendum and Democratic aspirations to move it from the November general election to the May primary election are the much larger forces. Senate Democrats introduced their legislative vehicle last Thursday and face a tight legislative timeframe to send it to the governor. The referendum politics will shape the weeks ahead, not just because of its substance, but because it changes the leverage and incentives around nearly every other decision in the building.