Finally, A Remarkably Unremarkable Revenue Forecast

For those of us who track state revenue forecasts like a hawk, we have grown to expect volatility. During the earliest days of the pandemic, state economists warned lawmakers the sky could be falling. Then, only a few months later, the unbelievable happened—state revenues came in higher and faster than ever anticipated. Each revenue forecast since the beginning of the pandemic produced shocking revelations about the state economy, revenues, and budgetary outlook. Oregon's latest revenue forecast, released this morning, tracks with the previous estimate for the first time in years. While it is too early to say the era of unpredictable revenues is over, this forecast represents stability and a break from the chaos.

In a presentation before the House Revenue Committee this morning, the state economists with the Oregon Office of Economic Analysis said there is a consensus forming around the Federal Reserve succeeding in a soft landing for the economy, where monetary policymakers pump the brakes on the economy by raising interest rates without crashing it into the ditch. While these rate increases are by no means painless on the economy, they are so far eliminating the doom and gloom scenarios long feared by economists. The risk is also far from over. In the weeks and months ahead, the Federal Reserve will need to decide whether to apply the brakes further with additional interest rate hikes, which could push the economy into a recession if they go too far. However, the state economists remain optimistic about the economy's trajectory and committed a recession from the forecast.

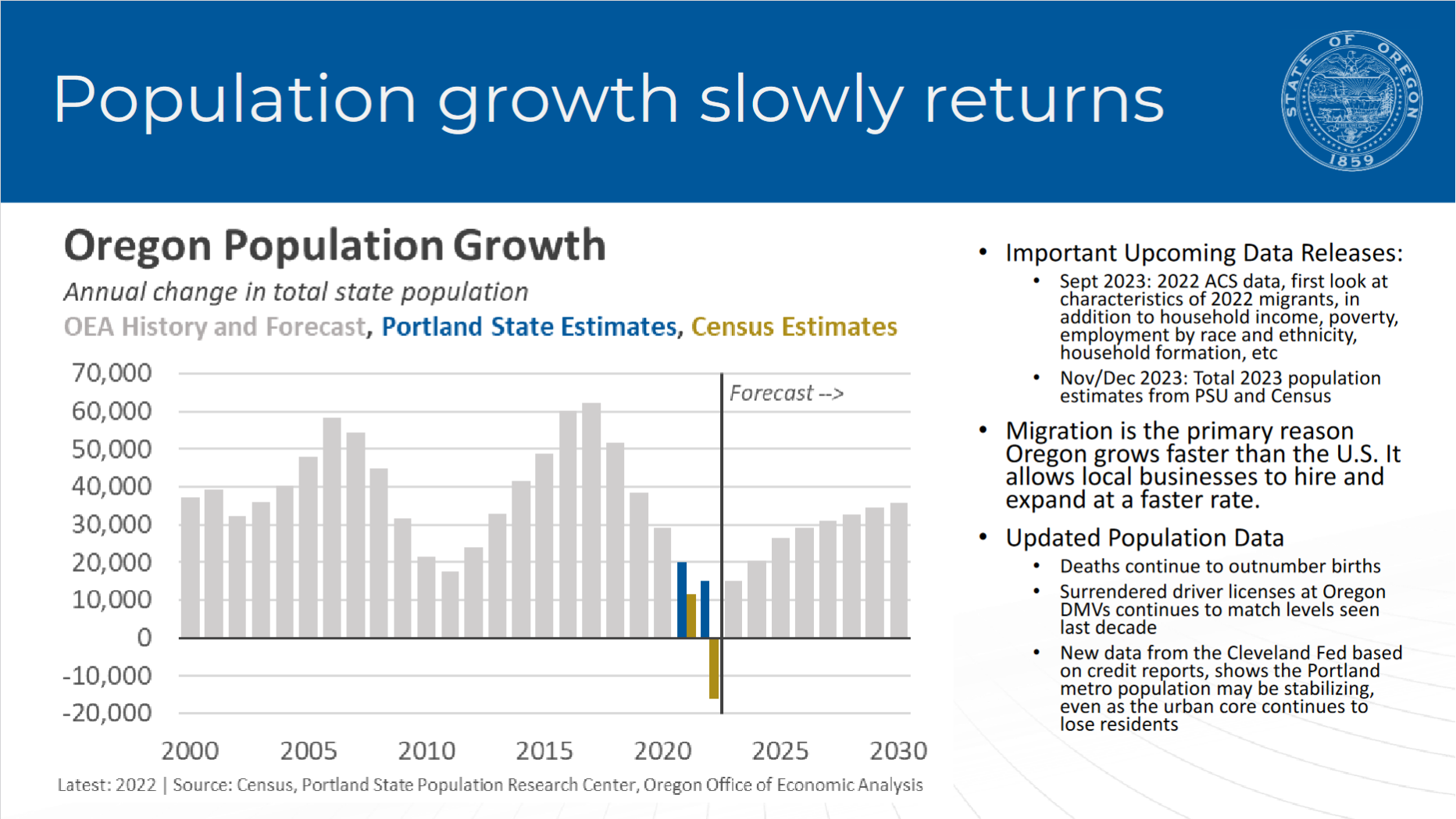

One data point the economists are following closely is the state's population trends, especially in the Portland metropolitan area. Over the last few years, Oregon has seen a significant shift in its natural population growth, with births dropping and deaths increasing, leaving the state reliant on migration for growth. Since 2020, the Portland metropolitan area has experienced population loss, potentially creating long-term economic and revenue stress if the trend holds. During today's presentation, the economists suggested an optimism these trends may only hold as temporary, with migrants again seeking the state as a place to work and live. A recent report from the Federal Reserve Bank of Cleveland analyzing credit reports in select metro areas suggests Portland's population growth is less negative than during the initial pandemic years, and the trend line is beginning to turn positive. The revenue forecast assumes the recent trend is only temporary and population growth resumes in future years, albeit slower than the last decade.

The economists also focused their attention on the influx of federal money that could flow into Oregon in the coming years. Congress enacted major spending packages for transporation infrastructure, semiconductor manufacturing, and clean energy projects in the last two years. If Oregon successfully attracts investments through these federal projects, it could significantly improve its economic outlook. In particular, the economists told the legislature that Oregon is uniquely positioned for semiconductor investments. Although some states are struggling to coalesce a workforce around production and manufacturing, Oregon's strength is in semiconductor engineering and prototype development, drawing fewer workers from other industries and creating less of a strain on the overall labor market. The economists also project a modest net employment increase from these investments—roughly 3,000 jobs—but the focus on engineering and other technical fields results in a significantly higher return on investment for the state and federal funding through higher salaries.

Economists Surprised by Strength of Corporate Tax Collections

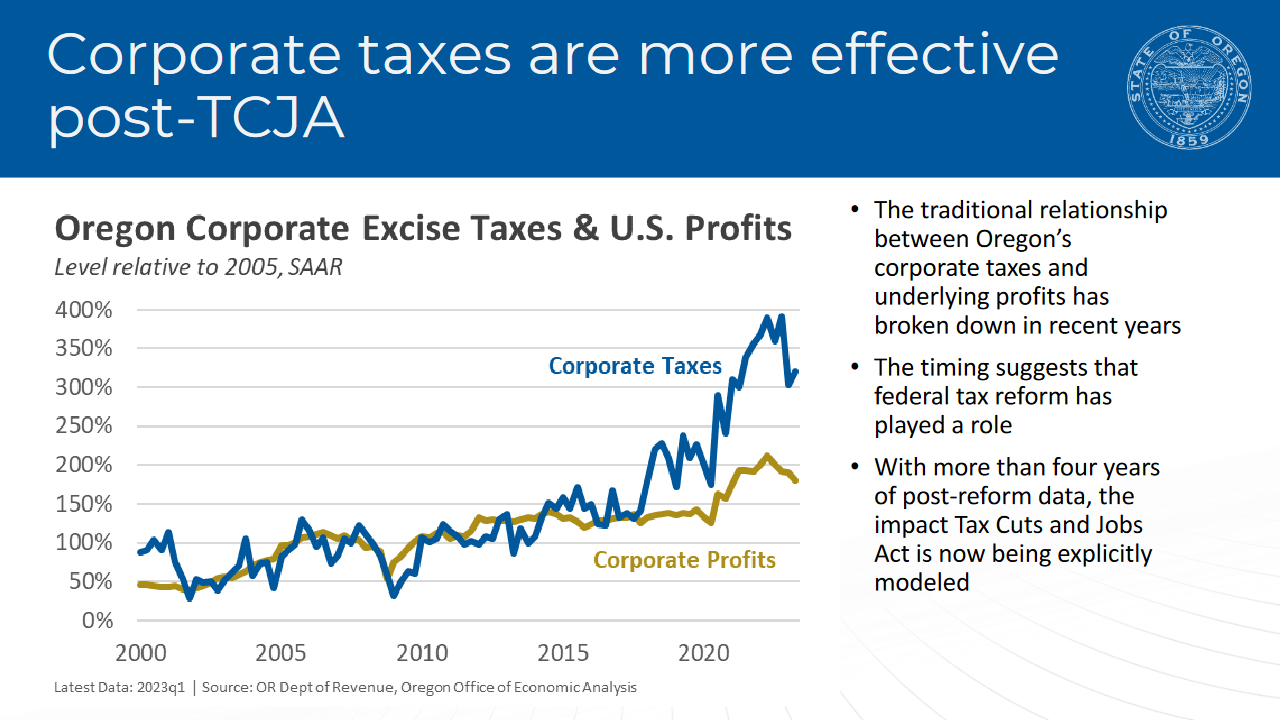

Like many other states, Oregon is experiencing robust growth in its corporate income tax. For decades, the corporate income tax became a declining source of revenue for states as business entity preferences shifted away from traditional corporations and towards pass-through entities, where businesses pay their taxes on their owner or shareholder's tax return rather than as an entity. These preferences provided preferential treatment towards closely held businesses that were able to escape a layer of taxation and blended some of the business tax burden into the personal income tax. The historical decline in corporate tax revenues often fueled rhetoric from tax-friendly groups to raise business taxes.

While corporate income tax revenues had been trending down for many years, it is no longer the story today. Until recently, corporate tax payments generally tracked overall corporate profits—if corporations were experiencing substantial growth, their tax liabilities typically followed. However, the trend has diverged and corporate tax payments are outstripping growing profits. The economists believe the Tax Cuts & Jobs Act of 2017 is likely responsible for untethering profits from tax payments at the state level. The law reduced the federal corporate tax rate from 35 to 21 percent, unwinding some of the economic incentives for a business not to redirect foreign earnings to the United States (and, thus, triggering tax). By changing those incentives, state economists are noticing a significant uptick in business taxable income, exceeding the traditional relationship with corporate profits. Since 2017, Oregon's corporate income tax collections have more than tripled, contributing $3.16 billion in the most recent biennium.

Overall State Revenue Outlook

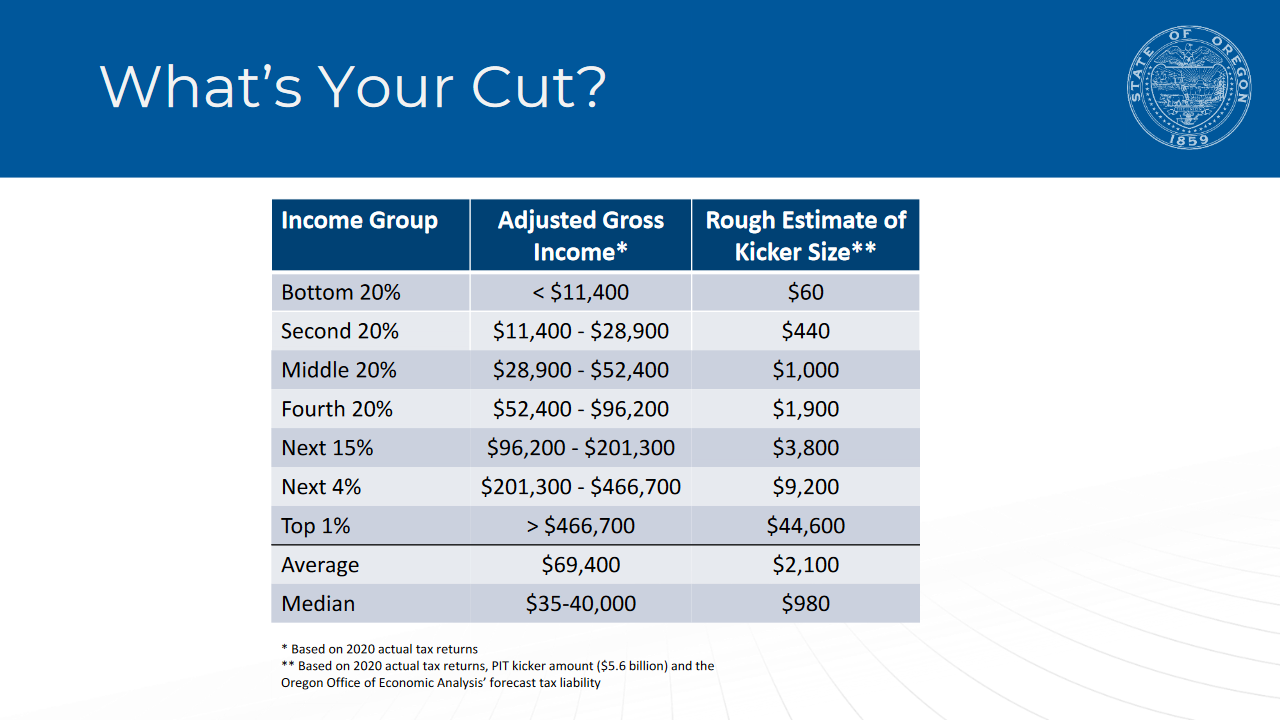

The first revenue forecast after a long session is special because it closes the books on the previous biennium and sets the bar for the next. The forecast is an important milestone as it marks the final revenue estimate before the economists are statutorily required to estimate the kicker refund amount by October 1. During the 2019-21 biennium, Oregon experienced its largest personal income tax kicker of $1.9 billion. In the biennium that just ended, however, that figure is likely to land at $5.61 billion, refunding taxpayers roughly 45 percent of their payments as a credit on their 2024 returns. Notably, the economists suggested the state must be careful managing its cash flow due to the historical size of the kicker payments next year.

Generally, state revenues are holding steady for the first time in many revenue forecasts. The economists project an additional $437 million in available General Fund sources, largely driven by growth in the corporate income tax and a quirky accounting rule counting some tax payments in the initial days of a biennium as funds from the previous biennium. Other tax instruments, such as the state's lottery and corporate activity tax, remain on track with their previous estimates.

Oregon's revenue forecasts have been the source of much drama and, at times, angst in politics, driving uncertainty about budgets and tax controversies. While the suspense can be interesting, it is a relief to finally see the waters calm, even if only for a moment. I hope you are all enjoying the final days of summer.