Economists Revise State Revenues Upward

On Wednesday, the legislative revenue committees received an updated economic and revenue forecast from Oregon’s Office of Economic Analysis. Three months ago, the state economists included a recession and a steep drop in government revenues in their baseline forecast. Now, however, after signs of easing inflation, the economists project a rosier outlook that avoids an immediate recession and maintains stable, perhaps even strong, revenue growth.

Oregon's Economic Outlook

The state economists are moving a recession out of their baseline forecast and back into their alternative scenario. For now, the forecast projects the “soft landing”—where the Federal Reserve raises the headline interest rates to tame inflation without tipping the economy into a recession—as the most likely outcome. The economists note Oregon’s economy has experienced robust growth over the past two years, with gains in employment, wages, and housing construction. However, they also highlight several challenges which could impact economic growth in the near future.

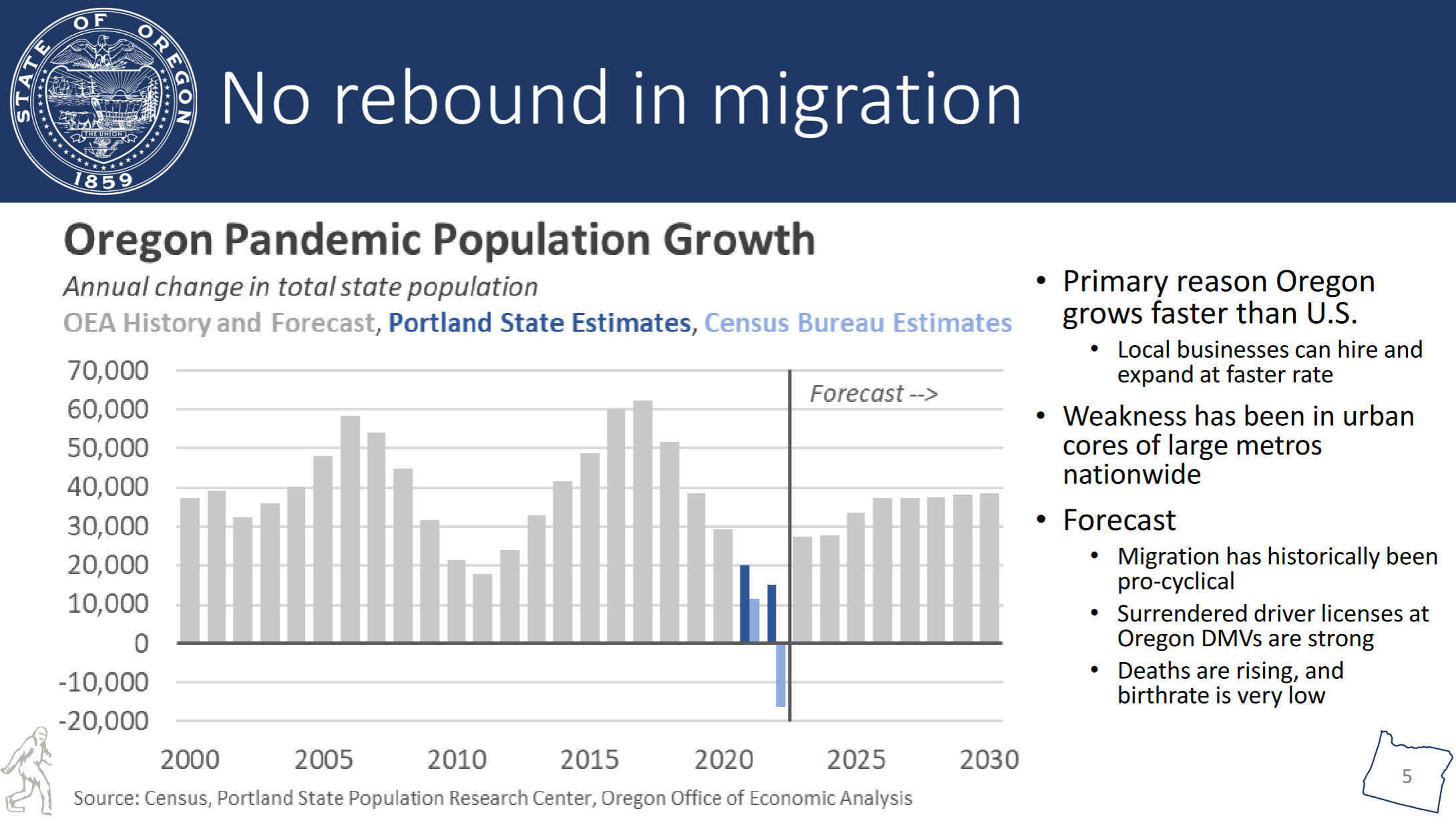

The greatest economic risks come from a tight labor market and declining population growth. Unlike previous recessions, Oregon’s population did not increase during the recovery and population estimates from Portland State University only show a small increase, whereas the 2020 Census shows a population loss. Compounding to this problem is the state’s aging Baby Boomers entering retirement amid a slowing birth rate. Ultimately, Oregon’s growth will likely slow because of a shrinking pool of workers, requiring employers to hire from the “latent labor force” (people underutilized in the workforce) and bring people into the state.

Another factor boosting the economic forecast is social security benefits. For 2023, the federal government adjusted its cost-of-living adjustment for social security beneficiaries by 8.7 percent, the single largest increase in the last 40 years, boosting incomes by 0.5 percent. While 0.5 percent might seem small, it is the equivalent of 22,000 jobs in the state. In communities where retirees account for a greater share of the overall population, primarily rural areas of the state, the increase materially improves the economic outlook.

The economists include an “alternative scenario” in their forecast, which plays a greater significance during times of economic uncertainty. In this forecast’s case, the scenario illustrates a more pessimistic outlook, where the economy falls into a recession in the near-term and three percent (60,000 people) of the state’s workforce becomes unemployed. Some industries, especially those producing goods, could experience larger losses at 4.5 percent of the workforce. Notably, the economists' report outlining the alternative scenario describes the recession as a “mild recession” beginning in 2024.

The alternative scenario has become more important in recent forecasts due to heightened economic uncertainty. In recent forecasts, the economists explained their preference is to defer to the more optimistic outlook because of the political ramifications. If lawmakers receive warnings that a recession (and a presumptive loss of state revenues) is imminent, they are likely to react to that information, which could position the state for steep spending reductions with long-term impacts on the greater economy.

From the report:

Keep in mind that the role our office's forecast serves is a budgetary planning tool. Until a recession is much more likely than not, it is best for the forecast to reflect an expanding economy, even while highlighting the growing risks. Our office does not take it lightly putting a recession in the outlook nor taking it away. As we wrote last quarter, it was not the fundamental economy that had changed but the relative assessment of the risks.Today one can make the case that the economy is fundamentally on a stronger ground both from a growth perspective and somewhat lower, yet clearly still elevated inflation. This change in the economy itself changes the timing and risk assessments of the outlook.

State Revenue Outlook

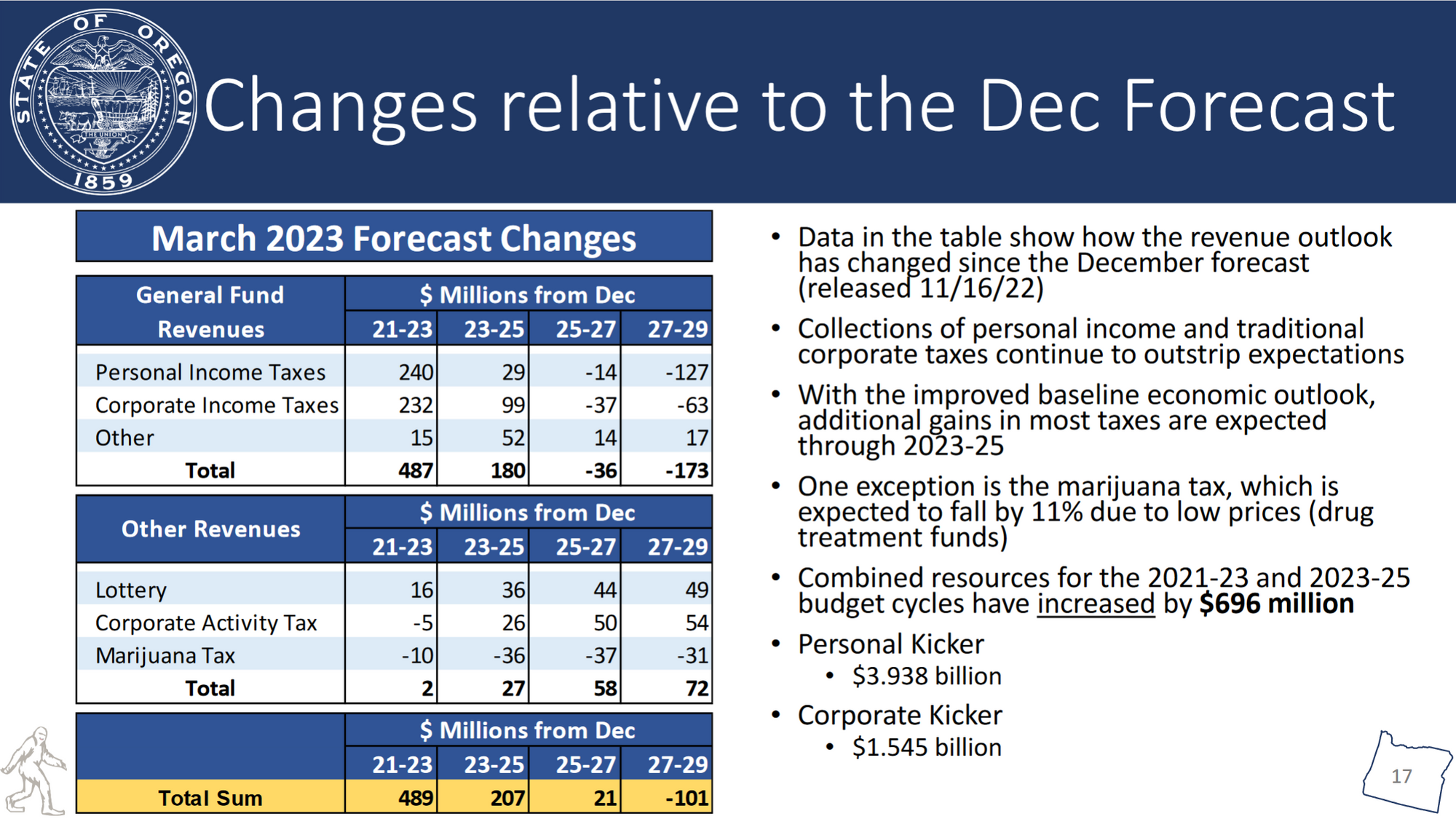

Although a recession remains a possibility, the improved economic outlook means the state’s revenue instruments are expected to perform stronger than the previous forecast. The economists revised the state’s revenue estimates upward for most taxes, except for the marijuana tax, which faces market issues due to oversupply. Much like the past several years, personal and corporate income tax collections are outstripping expectations, boosting the state’s general fund by $497 million since the last forecast a few months ago. Overall, lawmakers were told to expect $696 million in additional resources.

In their report, the economists suggest some of the increase in anticipated revenues could be an “illusion” due to taxpayer behavior. In 2021, Oregon enacted a special elective tax allowing s-corporations and partnerships to be taxed as a business entity instead of paying taxes on their owner or shareholder’s personal tax return. Under rules from the Internal Revenue Service, the tax allows these pass-through businesses to claim the full state and local tax deduction on their federal income taxes. However, the Oregon Department of Revenue rolled out its rules and instructions to taxpayers late into the year, meaning that taxpayers did not have an opportunity to adjust their withholding payments and may have overpaid. If true, some of the additional revenue may only be fictional.

Despite the boost in anticipated revenue, the economists maintained their warning that a hangover is on the horizon. Over the last few years, Oregon’s revenue stream has been buoyed by non-wage income, such as business, rental, dividends, and capital gains, which will be less prominent in a period of slower growth. Overall, state revenues are expected to drop by $3.5 billion between the current budget cycle and the next. Still, that amount is nearly $2 billion more than lawmakers budgeted for the 2021-23 biennium.

In the alternative scenario, where a soft landing does not occur, state economists suggest Oregon could see revenues drop by $2.4 billion during the 2023-25 biennium and an additional $1.1 billion in 2025-27. Although the state has made substantial progress in diversifying its revenue stream by adding the corporation activity tax, the recession would not spare those taxes. If the downturn outlined in the alternative scenario comes to fruition, the state would experience $362 million in less revenue for investments in public education.

Perspectives on the Revenue Forecast

The February forecast is the forgotten stepchild of revenue forecasts. It helps inform how we talk about tax and fiscal debates but does not provide enough information for lawmakers to cement their pathway forward. It is like running laps around the track in the days before a marathon to make sure you are in shape for the full course. Ultimately, the forecast is a status check, not the main event.

That said, the February forecast is the only opportunity to inform the session’s discourse on spending and revenue. The optimistic outlook should help keep some of the more prominent debates alive. These include tax incentives to boost business development and advanced manufacturing and new spending initiatives for housing, behavioral health, and the state’s social safety net. Perhaps most importantly, the increased revenue might mean lawmakers will not need to draw money from the state’s reserve accounts, which requires a supermajority vote. If so, some of the politics and leverage between the parties could calm.

Ultimately, much of the revenue conversation comes down to the upcoming tax season. Did business owners overpay their estimated taxes for the new elective tax? If so, those businesses could receive substantial refunds dragging down the surplus. Additionally, the state and national economic conditions will likely change between now and the end of the session, leaving much of the tax and fiscal politics on standby until the June forecast, which, despite its name, is scheduled for May 17.