State Economists Project Mild Recession in Baseline Forecast

Oregon’s baseline economic forecast only a few months ago called for a slowing economy but not a recession. State economists then aligned their expectations with the “soft landing,” where the Federal Reserve steers the national economy through a contraction without driving it into a recession. Today, during a joint hearing of the legislature’s revenue committees, the economists released an updated revenue forecast where they switch lanes. “The sharp rise in interest rates is akin to taking one’s foot off the gas and slamming on the brakes,” said the economists with Oregon’s Office of Economic Analysis. “The car will shake, skid and even fishtail. The ultimate question is does it end up in the ditch or is the driver able to pull out of it?”

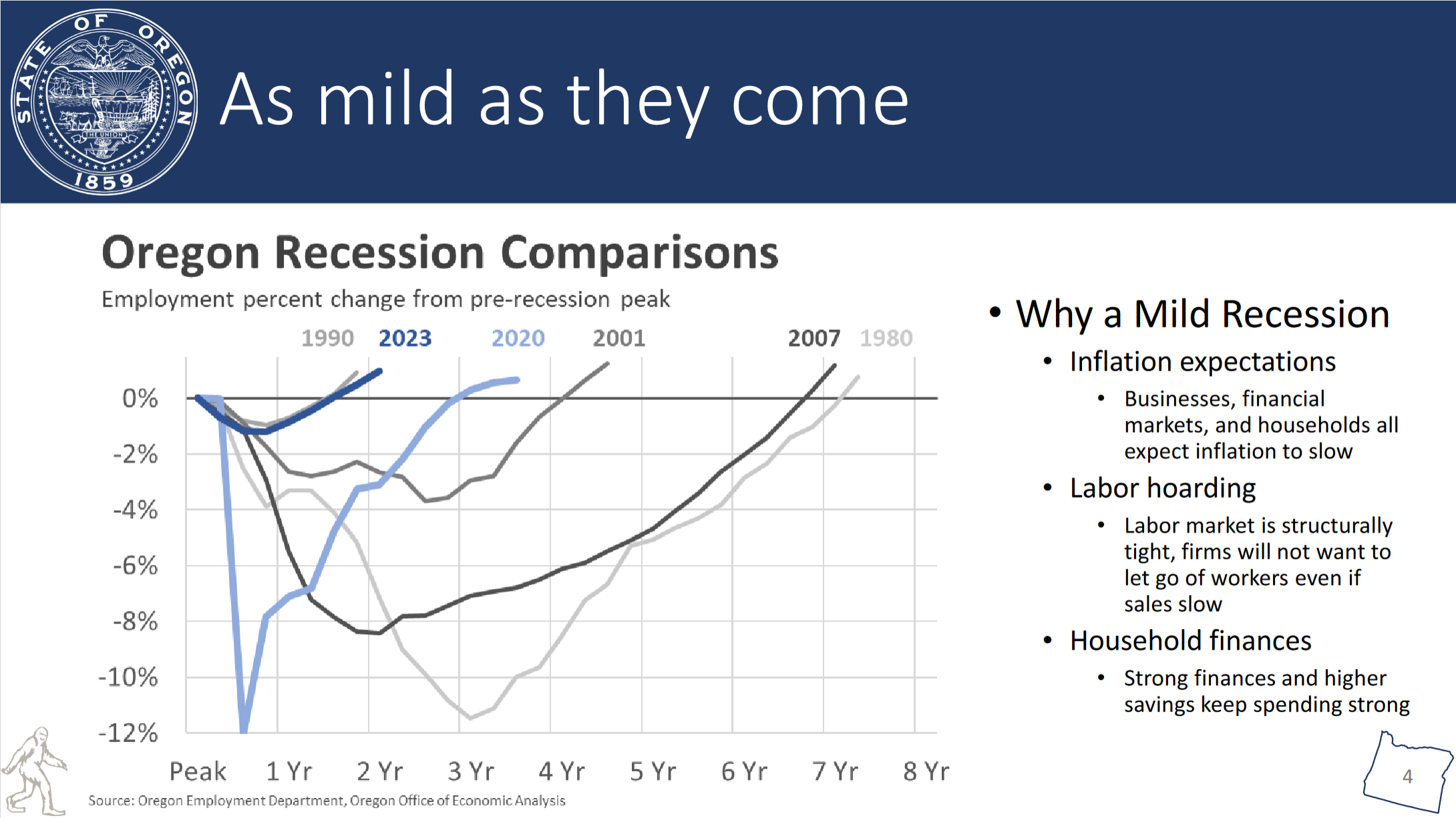

The economists remain hopeful that Oregon’s outlook remains more optimistic than some projections suggest and that the recession, likely occurring in the second half of next year, will be mild compared to other recent recessions. They attribute three reasons for their optimism. First, surveys of businesses and households indicate that people believe inflation will slow in the coming years, suggesting inflation is not yet entrenched in the economic fundamentals. Second, the tight labor market will make it difficult for employers to let go of their workers, despite declining revenues. Third, consumers continue to have sizable savings, helping them withstand a recession and, ideally, short-circuiting the typical consumer feedback experienced during a recession.

The discussion spent a decent amount of time comparing the forecasted recession to the 1991 recession. In 1991, the economy went into recession without widespread layoffs. However, that recession was unique because the result was a downturn without a material decline in government revenues. Since Oregon’s revenue growth in recent years stems from non-wage sources of income, such as capital gains, it is unlikely that Oregon can dodge a decline in tax collections. As profits and investment incomes decline and the tax collections from those sources come back down to Earth, the state’s tax revenues are expected to fall roughly $3 billion.

Although $3 billion is a large and frightening number, especially in a state with a General Fund budget totaling approximately $29 billion, the drop has been expected for a long time. Before the pandemic, state economists were bracing policymakers to expect a decrease in available revenues as the economy boomed in the late 2010s. The decline never appeared as the shock waves of the pandemic and fiscal stimulus became the predominant economic narrative. The expected decline in revenues from the anticipated recession is a way for the economy and tax collections to find equilibrium. In fact, the revenues forecasted for the 2023-25 biennium are roughly $500 million more than the economists’ predicted for the same period before the pandemic.

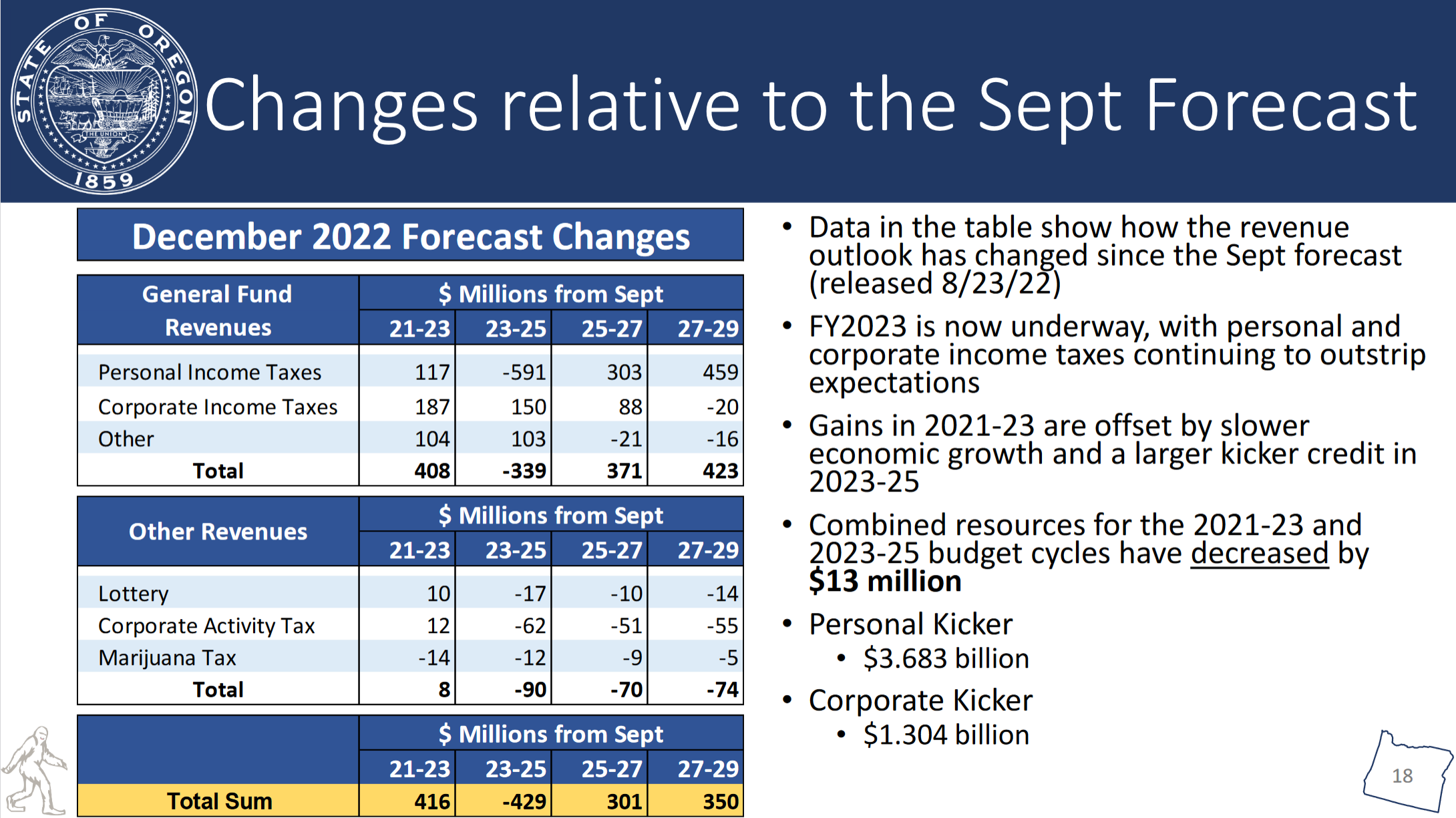

State revenues, especially income taxes, reflect past economic conditions and lag behind recessions before declining. Oregon’s current revenue outlook calls for continued growth for the current budget cycle, amounting to $430 million in additional resources since the last forecast ($5 billion from the start of the biennium). The continued growth in the forecast raises the projected personal income tax kicker to $3.683 billion, an increase of $221 million since the last forecast. Anticipating a recession, the economists are lowering the expected revenues for the next biennium by $339 million to $25 billion.

Regardless of the economic conditions, Oregon’s fiscal health is much stronger than in previous downturns. The state has two reserve funds, a constitutional reserve account for education and a statutory general-purpose reserve fund, to tap into during poor economic times. By the end of the current budget cycle, the state economists project the combined amount for the two reserve accounts to total nearly $6.2 billion, limiting (but not eliminating) the budget dramas from previous recessions.