Oregon’s Economy Shifts from Boom to Balance

Economic Forecast

Oregon’s economy is beginning to show signs of shifting from a prolonged inflationary boom to a more sustained expansion, Oregon’s Office of Economic Analysis told the legislature during a joint meeting of the tax-writing committees. After enduring the pressures of high inflation and interest rates, there are signs the state is entering a phase of slower but more stable growth. The Federal Reserve’s upcoming decision on lowering interest rates will prove crucial in determining the trajectory of the state and national economies. While the Fed has managed to contain inflation, the longer interest rates remain elevated, the greater the risk of a recession.

Perhaps more than any other indicator, the labor market reflects this delicate balance. Although layoffs have remained low, the hiring rate has also slowed significantly, causing the unemployment rate to creep up slightly. This softer labor market presents a mixed picture: while key indicators such as job numbers and labor force participation remain strong, the dynamics beneath the surface suggest a period of adjustment. Firms are more cautious in their hiring, opting to manage costs through attrition rather than significant layoffs. As a result, it is taking job seekers, especially those newly entering the labor market or those recently laid off, longer to find employment. This trend is underscored by a rise in the unemployment insurance benefit exhaust rate, indicating that more people are exhausting their benefits before landing new jobs.

Despite new challenges in the labor market, the forecast does not indicate a looming recession but, rather, cracks emerging. “Transitioning from the inflationary economic boom to a sustained expansion always required slower inflation and underlying growth,” the economists wrote in their report. “The challenge is the path that leads to a recession also starts this same way, the slowdown just progresses all the way into a downturn.”

State Revenues Continue to Surge

Oregon’s revenues have consistently outpaced expectations in recent years. Although the economy is shifting from boom to balance, tax collections still exceed previous estimates, leading the economists to raise the projected available funds by $676 million since their last forecast three months ago. The state’s robust tax collections offer a snapshot of economic strength; however, it is important to recognize these figures largely reflect the previous year’s economic activity rather than current conditions.

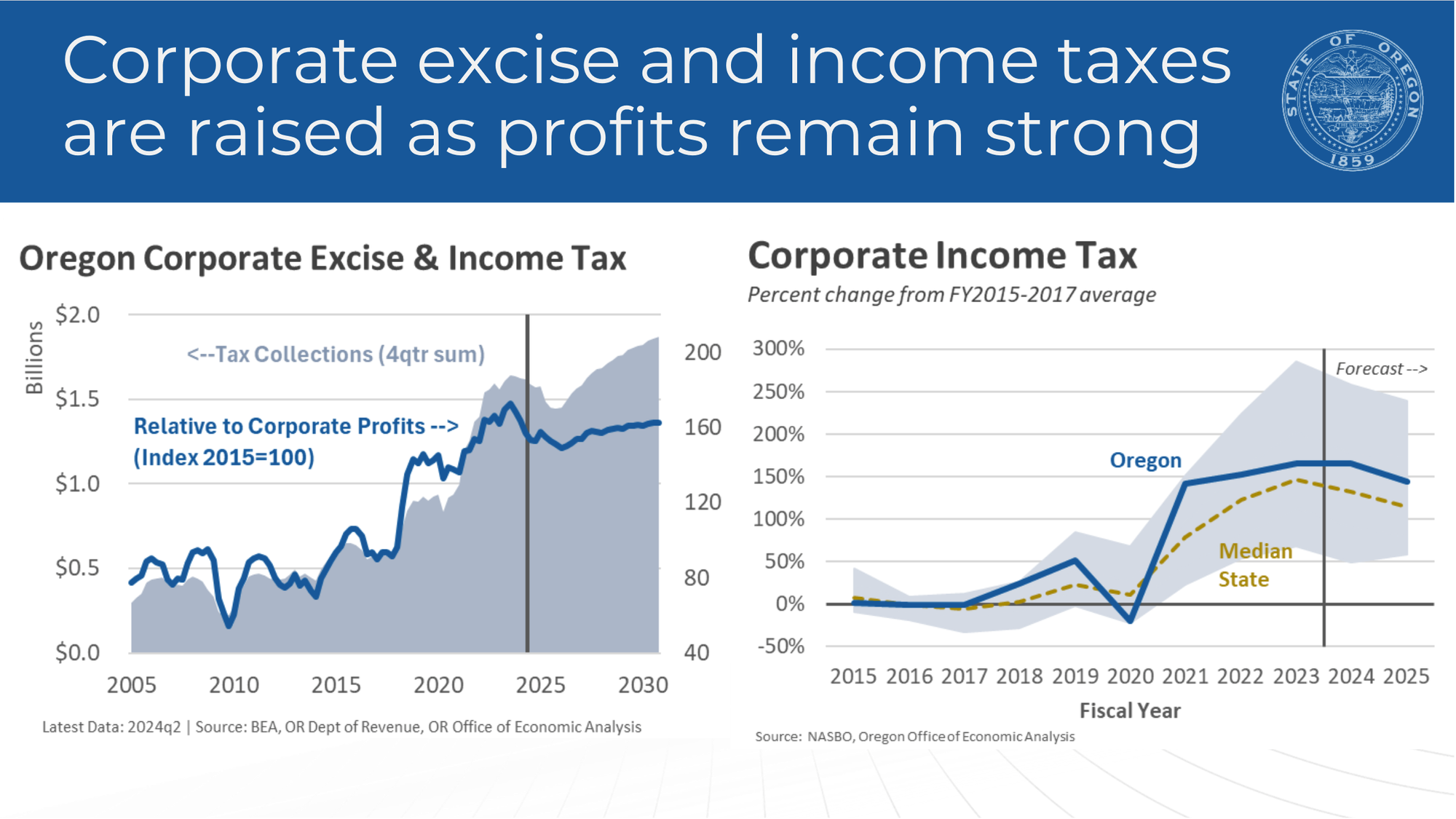

The state’s surplus revenues are largely driven by surging personal and corporate income taxes. Despite increasing rapidly over the last several tax seasons, the persistent surge in corporate tax collections has taken many economists by surprise. Initially, it was anticipated that recent tax policy changes, such as Oregon’s adoption of market-based sourcing and the federal Tax Cuts and Jobs Act in 2017, would only nominally or temporarily boost corporate tax revenues. Contrary to these expectations, the actual revenues collected have been larger and more persistent, leading economists to believe these changes are likely permanent.

The political discourse throughout the 2010s in Oregon prominently featured calls to raise corporate taxes, relying on the assertion by some that corporations only contributed seven percent of all income taxes. Today, the composition of taxes paid by corporations is fundamentally different, with corporations contributing more than 21 percent of the overall tax revenue from major sources. While this realization is unlikely to exterminate claims by some tax-friendly groups and lawmakers, it is important to recognize the foundation of tax debates has, or at least should, fundamentally changed.

The increased projections also raise the prospects for the personal and corporate income tax kicker. According to the latest forecast, the economists now estimate a personal income tax kicker of $987 million, credited to taxpayers in 2026. Similarly, the strong corporate tax collections have increased the projected corporate kicker to $883 million, which would be distributed to public education spending during the 2025-27 biennium.

Changing of the Guard in the Office of Economic Analysis

Earlier this year, Mark McMullen, Oregon’s longtime chief economist, announced his departure to join a new policy think tank. Today, Josh Lehner, the office’s most senior economist and one of the most prominent voices on the state’s economy and revenue outlook, revealed his plans to transition to the private sector after 15 years with the state. With the end of a long period of stability at the helm of Oregon’s economic forecasting office, the state now faces a significant changing of the guard.

The office’s role has expanded in recent years. Beyond its core function of tracking economic and revenue trends and producing forecasts to guide legislative budget decisions, the office has been tasked with predicting economic conditions related to key policy initiatives, such as housing and clean fuels. It has also faced political criticism from public employee unions and progressive lawmakers for allegedly underestimating revenue forecasts.

Forecasting the state’s economy is one of the most challenging tasks in state government—accurate predictions often go unnoticed, while inaccuracies can create significant political and budget complications. The loss of two key experts represents a substantial depletion of institutional knowledge at a crucial political juncture. With a massive corporate tax measure on the ballot, designed to fund a form of universal basic income, the need for reliable forecasts has never been more critical. Should the measure pass, the state’s personal income tax kicker would become inextricably linked to corporate tax collections, unleashing profound uncertainty into the budget-writing process.