Oregon’s Revenue Forecasting Gamble

Oregon lawmakers received optimistic news this morning—the state’s new chief economist is projecting substantially higher revenues for the legislature to spend during its next session. While additional resources are generally a good thing, the news also carries the potential for significant controversy.

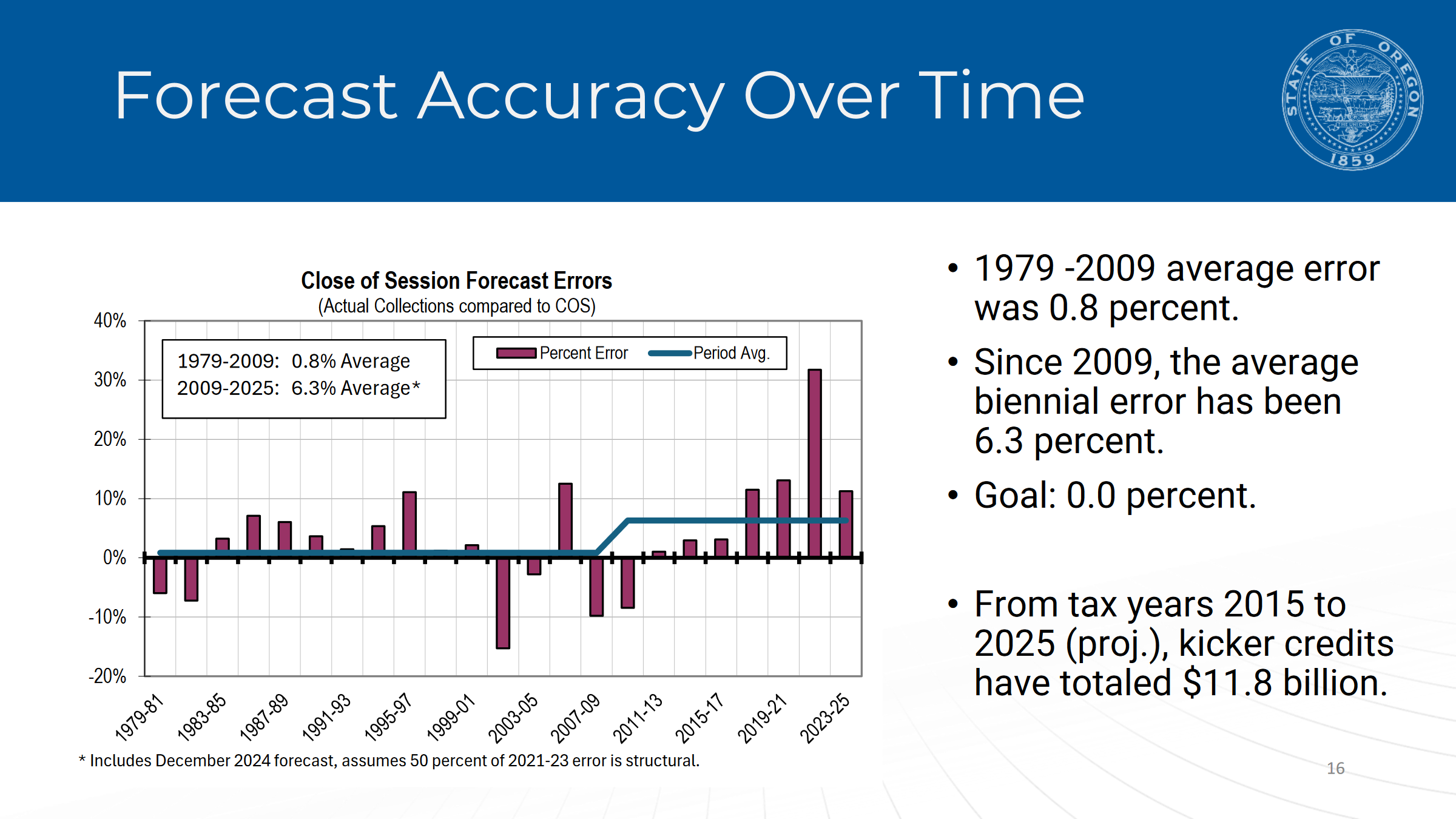

In September, the state hired Carl Riccadonna, formerly an analyst with Deutsche Bank and Bloomberg, as its new chief economist. He replaces Mark McMullen, who left earlier this year to join a nonprofit think tank, taking the helm of one of Oregon’s most influential yet complex roles. McMullen faced criticism from some lawmakers and advocacy groups over forecasts that often underestimated revenues, leading to unusually large personal income tax refunds—known as kicker refunds—in recent years.

Economic forecasting in Oregon has been uniquely challenging over the past several years, particularly with regard to the kicker refunds. Oregon’s overall revenue structure is highly reliant on personal income taxes, leaving state finances often at the whim of the business cycle. Oregon’s revenue stream benefited significantly from the 2017 federal tax reform law, which Congress enacted during the middle of a budget cycle. Then, in 2020 and the years following, the pandemic and the government’s response to it fueled unanticipated and repeated revenue surpluses. Changes in consumer spending during shutdowns, coupled with federal stimulus measures like enhanced unemployment benefits and direct payments to households, drove a surge in personal income. These unforeseen events, along with Oregon’s high and broad income taxes, funneled significant new revenues to the state. While critics may fault former economists for “missing” their forecasts, the sheer unpredictability of these economic shocks made accurate forecasting nearly impossible.

Riccadonna outlined steps his office took to overhaul the state’s forecasting methodologies in response to criticisms. His office has revised key assumptions, including incorporating the kicker directly into the personal income tax model and aligning local economic projections with national trends. The changes aim to reduce the likelihood of forecast “misses” triggering Oregon’s unique constitutional refund. Today’s revenue forecast marks a shift from a traditionally cautious approach to one with a more ambitious and optimistic outlook.

The new methodology significantly boosts projected revenues for both the current (2023-25) and upcoming (2025-27) biennia. The forecast more than doubles the current kicker estimate, increasing it from $987 million to nearly $1.8 billion—funds that would be returned to taxpayers in 2026. While the immediate result is larger kicker refunds, the long-term effect is a state forecasting methodology that predicts stronger revenues at the onset of a biennium—making it much more difficult to trigger the kicker. Additionally, lawmakers now anticipate $1.3 billion in new revenues and a $945 million beginning balance carried over from the current biennium. Together, these adjustments add $2.27 billion in newly available resources for the next budget cycle, driven largely by changes in the forecasting model.

Over the long term, these changes signal a fundamental change in the state’s forecasting preference toward maximizing projected resources. In states without a kicker, such adjustments might carry minimal political weight. For Oregon, however, the stakes are high. Downturns tend to sting harder and last longer in Oregon relative to the rest of the country, and the rosier forecasting assumptions to the model could exasperate those impacts. Now more than ever, it is crucial for the legislature’s budget writers to ensure a healthy budget cushion or else face unpopular decisions such as cutting spending or raising taxes.